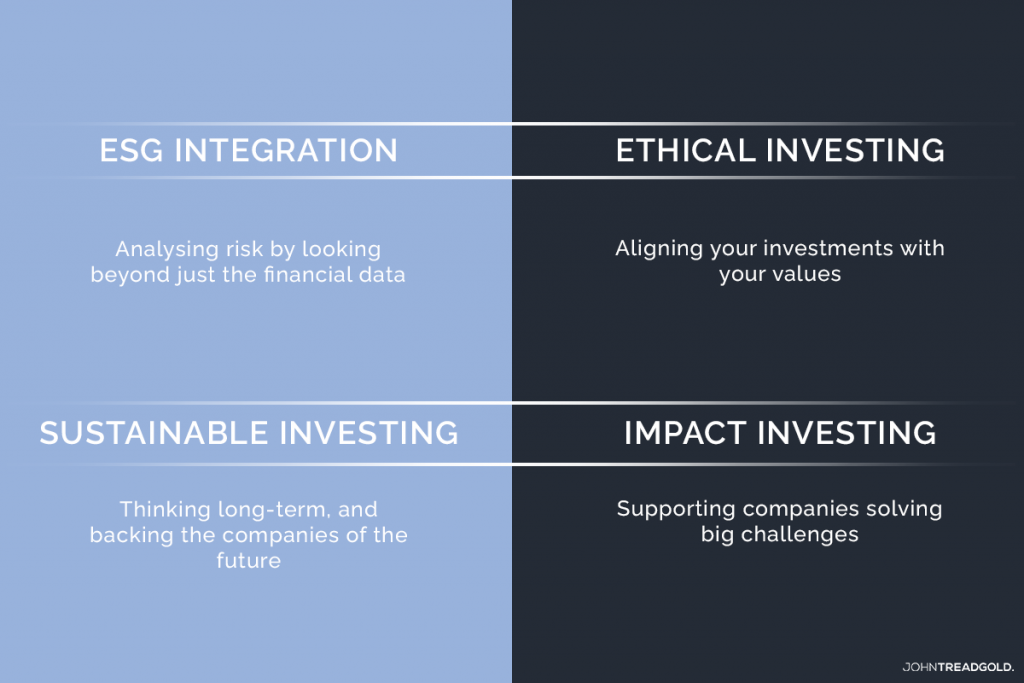

The financial landscape is evolving rapidly, driven by growing investor awareness of environmental and social issues. This has led to a surge in approaches to ‘responsible investment’, each with distinct characteristics. This article aims to clarify the differences between Ethical Investing, ESG Investing, Sustainable Investing, and Impact Investing.

Your money has power, hopefully these insights will help you direct it for maximum impact.

What is Ethical Investing?

Ethical investing is aligning your investments with your values

Ethical Investing focusses on avoiding investments that aren’t in-line with your principles, morals or ethics. This most often comes in the form of exclusions, or negative-screens in industries with poor ethical standards, which might include:

- Weapons manufacturing: Including nuclear, landmines, and cluster bombs

- Tobacco production: Due to its well-documented health risks

- Gambling: Considered by some to be socially harmful

- Pornography: Often viewed as exploitative

This is one of the oldest forms of shareholder activism, adopted by religious groups many centuries ago, and deployed in the 70’s to protest apartheid in South Africa.

It’s often referred to as a ‘do-no-harm’ approach.

An ethical investment approach may reduce the investible universe that is available within a portfolio, but, it may also reduce risk as the excluded industries are more likely to face challenges like; customer-backlash, regulatory barriers or public relations scandals.

What is ESG Investing?

Analysing risk by looking beyond just the financial data

All investors use a selection of financial data and economic indicators to analyse a company. But ESG investors go further, they also analyse Environmental, Social and Governance (ESG) factors when assessing a company’s potential for success.

A more precise term is ESG integration, which commits an investor to integrating ESG factors into their decision making.

It’s a way of analysing investment risks, while maximising opportunities others don’t see.

It’s important to note that an ESG approach won’t necessarily exclude (or divest from) companies based on your values or your ethics.

ESG investors analyse non-financial factors, and this gives them an edge. But it’s not easy, ESG factors are far more difficult to measure than the clean-cut financial data of earnings, profit and loss.

Environmental factors include:

- Climate change, carbon emissions, water management, waste, biodiversity, renewable energy, green building and clean technology.

Social factors include:

- Human capital, labour standards, product and chemical safety, privacy and data security, controversial sourcing, access to healthcare and finance.

Governance factors include:

- Board and leadership structure, pay equality, ownership, ethics, corruption, taxation transparency and anticompetitive behaviour.

ESG is a form of Best-of-Sector investing. Instead of ‘excluding’ whole industries from your investable universe, you identify the companies that performed best among their industry peers in terms of E, S and G factors.

Engagement is another important tool when trying to find ways to influence company behaviour, and to protect your investment portfolio. Engagement involves opening-up a dialogue with a company to express your concerns as an investor, and even suggest some solutions, to key problems you’ve identified. It avoids the blunt-instrument of simply divesting, and it gives you a seat-at-the-table to influence positive change.

What is Sustainable investing?

Thinking long-term, and backing the companies of the future

Sustainable investing is less about avoiding sin-stocks, and more about identifying sectors that are leading the way on sustainability and progressive technologies.

This approach uses a positive-screen to highlight companies that are solving environmental and social challenges.

Renewable-energy is a key example; it can avoid the pollution of fossil-fuels, to produce clean energy from the sun and the wind. And fossil-fuel companies are increasingly facing stranded-asset risks and onerous regulations.

But as with ethical investing, it also reduces your investible universe.

What is Impact Investing?

Supporting companies solving big challenges

Impact Investments intentionally aim to make a positive impact, and a positive return.

Impact investing is the most rigorous investment approach in this series, and it has the greatest potential for positive change.

Since the term was coined in 2007 at a Rockefeller Foundation gathering in Bellagio, Italy, impact investing has transformed from a niche strategy into a mainstream investment approach. In 2024 the Global Impact Investment Network (GIIN) estimated the impact investing market exceeds $US1.5 trillion in assets under management, which represents dramatic growth.

Being able to measure the impact of an investment is key. Impact measurement needs to be as rigorous as the accounting standards we apply to profit and loss. These metrics can shift an investments interest rate, the rate of return and sometimes ever a fund manager’s remuneration.

The challenge is that as yet there are no universal measurement frameworks. IRIS+ from the GIIN is a good start, and the SDGs have been widely adopted as a unifying approach, but there are many other metrics out there, and so far it’s difficult to compare one impact strategy with another.

The field is evolving at a rapid pace. The potential for impact is clear, and the ability to accurately and transparently measure it has been proven. The challenge now is to broaden and deepen the market, with the hope of influencing all investors.