Impact investing is proving investment capital can be a powerful force for positive change, while also generating competitive financial returns.

Today’s investors increasingly demand their capital works harder, delivering both financial returns and measurable positive impact on society and the environment. Investment managers have answered the call, with impact investment funds that deliver positive real-world outcomes across a huge range of themes, and covering the full spectrum of asset classes.

The best of these investment firms identify high-impact companies, but they also contribute more to their investee companies than just financial capital, they leverage their experience and expertise to help companies grow their positive impact outcomes. Savvy investors now consider risk, return and impact.

In this article I’m going deep to explore:

How to define Impact Investing:

Mainstream adoption of Impact Investing

Two types of Impact Investing: environmental & social

Impact Investing across the spectrum of asset classes

The key methods of impact measurement

How to get started with Impact Investing

The future of Impact Investing

How to define Impact Investing

Impact investments are those made into companies, projects, and funds with the intention to generate a measurable social or environmental impact alongside a financial return.

To further narrow this definition, there are three key elements that distinguish impact investing from other forms of responsible investing:

Intentionality: Investors must actively seek to create positive impact

Measurement: Outcomes must be measurable and reported regularly

Contribution: Investors will support delivery of impact outcomes with more than just financial capital

Differentiating Impact Investing from other forms of sustainable investing

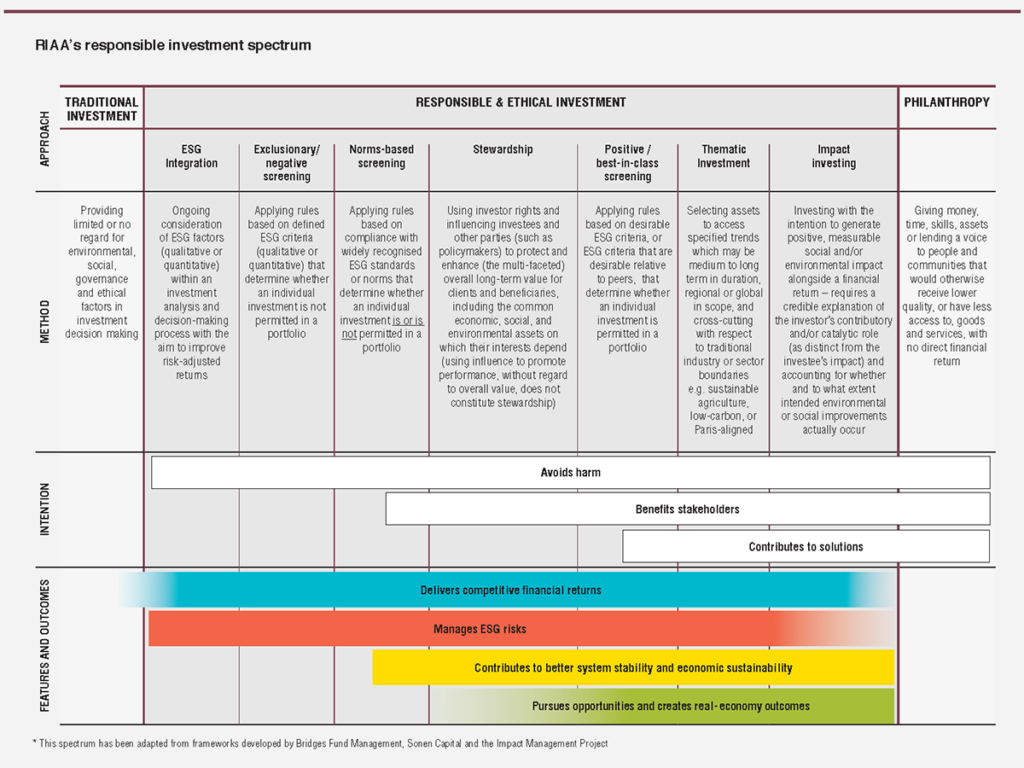

Impact investing is a form of sustainable investing. On the spectrum of sustainable investment (link to other article) approaches it is arguably the most rigorous due to its focus on delivering measurable real-world outcomes.

While ESG investing looks at the risks related to Environmental, Social and Governance factors, impact investing identifies projects and companies delivering solutions to the world’s biggest challenges.

Ethical investing is all about values, and most often leads investors to screen-out industries that aren’t morally aligned.

And there are a range of other tools investors can use to manage social and environmental risks, and gain exposure to the opportunities of sustainable investing, such as: stewardship, exclusions and thematic investing.

Mainstream adoption of Impact Investing

Since the term was coined in 2007 at a Rockefeller Foundation gathering in Bellagio, Italy, impact investing has transformed from a niche strategy into a mainstream investment approach.

In 2024, the Global Impact Investment Network (GIIN) estimates the impact investing market exceeds $US1.5 trillion in assets under management, which represents dramatic growth.

This surge reflects a fundamental shift in how investors view their role in addressing global challenges. As governments struggle to effectively tackle issues like climate change, social inequality, and biodiversity loss, private capital has stepped up to drive meaningful change.

Early growth in impact investing came from philanthropists, with investments made into projects aligned with their charitable mission, and sometimes offered with a concessional rate of return. Today, this approach is called catalytic capital, and is mainly adopted by charitable foundations and international development agencies.

Since then the market has gone mainstream with commercial impact investment strategies targeting competitive financial returns. There is no longer a need to make a trade-off between financial returns and impact outcomes. The market and its operators now have access to sophisticated impact frameworks, they have a track-record of performance and experience in aligning impact value with financial returns.

Two types of Impact Investing: environmental & social

Impact investments are generally separated into two groups: environmental and social. Emphasising the universe of positive outcomes the investments are targeting.

Environmental Impact Investing

The environmental impacts of climate change have made efforts to reduce carbon emissions and deploy renewable energy one of the dominant impact investment themes.

‘Climate investing’ has emerged as a standalone approach to avoiding the risks of climate change, and leveraging the opportunities flowing from the transition to a low carbon economy.

Other environmentally focussed themes include: the protection of natural capital and reduction of biodiversity loss, waste and recycling, ocean health, and regenerative agriculture.

The key outcome is to reduce CO2e emissions, and a mature industry has emerged to measure and quantify carbon data across the economy.

Social Impact Investing

Impact investors targeting social outcomes focus on addressing complex societal challenges such as poverty alleviation, access to education and healthcare, affordable housing, and gender equity. These investments often aim to uplift marginalized populations and foster systemic change.

Social outcomes are inherently qualitative, requiring nuanced measurement approaches. Indicators may include: access to education, improved healthcare outcomes, or measurable improvements in social mobility and economic inclusion.

Impact Investing across a range of asset classes

Impact investing is not a standalone asset class, rather, it’s a lens through which to view investments in a whole range of asset classes.

Today, you can find impact strategies that cover the spectrum of asset classes, and while they’re diverse in their structures, risk profiles and outputs, they all retain the same commitment to the core impact attributes, of: intentionality, measurability and contribution.

Private Equity (PE) and Venture Capital (VC)

It’s argued that impact investing got its start in private equity, a space where investors may take a majority share in a company to change its trajectory and improve performance. This approach has been historically applied for solely financial gain, but by looking through an impact lens, both the business and impact performance of a company can be improved.

Bain Capital’s Double Impact firm focuses on investing in mission-driven companies in North America. With equity investments ranging from $20 to $80+ million, Bain applies its operational expertise to help portfolio companies scale and maximize their impact potential. The strategy leverages Bain Capital’s extensive private equity experience and globally integrated approach, and employs their own ‘B Analytics’ impact measurement framework.

Just Climate is a most recent example of a PE firm focussed on delivering big returns that are driven by its potential for impact. Just Climate calls its approach climate-led, targeting industries that are the most challenging to decarbonise. These hard-to-abate sectors include steel making, transport and renewable energy.

Listen to an in-depth interview with Senior Partner Clara Barby here.

Fixed Income and Bonds

Fixed income is well-suited to impact investing, and green bonds and social impact bonds experienced explosive growth in 2024:

The green bond market exceeded $1 trillion in 2022, according to Climate Bonds Initiative

Social impact bonds are addressing diverse challenges from refugee employment to healthcare access

A notable example is the Asian Development Bank’s (ADB) $7.6 billion green bond issuance in 2024, their largest annual green bond program to date. The bonds support climate change mitigation and adaptation projects across Asia and the Pacific, demonstrating how fixed-income instruments can effectively channel capital toward environmental solutions while providing stable returns to investors.

There’s a number of reasons why fixed-income dominates the impact segment: first, deal sizes can be scaled-up without diluting the impact, while still maintaining a small pool of large investors. Second, the structures tend to be more stable: they’re longer-term, and they’re less exposed to daily market moves. This makes it easier to capture impact data.

It makes sense for debt markets to engage with impact investing. Not only due to the risk-mitigating nature of responsible investments, but simply because they offer another layer of analysis and stability.

Public Equities

Recent innovations have made impact investing accessible through public markets.

Fund managers like WHEB in the UK have a useful model that only invests in companies whose products make a positive impact (you can read my case-study of the firm HERE). While Australian fund manager Northstar Impact only invests in solutions to social and environmental challenges.

When we consider Impact Investing vs ESG, we see that impact is at the more rigorous end of the spectrum. It’s good to see attempts being made to apply the high standards of impact to listed equity strategies, but there are challenges.

The key issues are;

- How can you influence the company, to steer it towards impact? It’s unlikely that you’ll have a big enough shareholding to exert your will on management. These companies have a dispersed roster of shareholders, as well as diverse customer base. Your focus on the broader impacts may not be shared by the other stakeholders.

- How do you measure the impact? Impact measurement is already difficult enough when shareholders and management are working together. But most big, public companies don’t yet have capacity to produce the types of data that impact investors require.

These are big challenges, but they’re not insurmountable.

If the concept of impact investing hopes to reach sufficient scale to truly shift the world towards sustainability and equality, then we’re going to have to find a way to influence these immense, publicly traded companies.

Real Assets and Alternatives

Infrastructure

Solar farms and wind turbines have become huge industrial complexes, but only ten years ago it was difficult to get funding. Impact investors were the pioneers that led renewable energy to become a mainstream part of the energy mix in the grid.

Today, investors like Brookfield Renewable Partners continue to take risks and lead the market on large-scale projects that make our economy more efficient and more sustainable.

Natural capital

Nature is all around us, but many businesses take for granted the resources and services that it provides. By recognising the value of Natural Capital we can make progress in conserving the biodiversity of ecosystems and halting the potential for large-scale ecological collapse.

New Forests is a sustainable forestry and agriculture company that has pioneered a range of methods for reducing the impact of forestry on the land, as well as scaling methods of regenerative agriculture.

By focussing on long-term outcomes, New Forests has quantified the value in healthy soils, rich biodiversity and engaged communities. By embedding these goals into their production processes they are able to derive financial value from positive impact outcomes.

Carbon credits

Carbon credits have emerged as a critical tool for achieving net-zero emissions and incentivising sustainable practices. They put a price on carbon sequestration, which means assets like forests, oceans and mangroves have greater value in their natural state. Organizations like South Pole have been instrumental in creating robust frameworks for the generation, validation, and trading of carbon credits.

By supporting projects such as reforestation, methane capture, and renewable energy installations, carbon credits not only offset emissions but also drive capital towards impactful environmental solutions. The voluntary carbon market continues to grow as businesses seek credible ways to meet their sustainability goals, providing a scalable mechanism for funding climate-positive projects globally.

What type of investors are involved?

Institutional Investors

Institutional Investors like super funds, insurance companies and other capital allocators have been slowly increasing their exposure to impact investments.

This is a highly pragmatic group of investors, but they’re also long-term investors, which means climate change and the social dislocations from inequality are material risk factors for the capital they invest for members.

These are well resourced organisations with large teams of financial analysts; they make a valuable contribution to developing impact norms, and showing that big allocations can be made to impact investments.

High-net worth and family offices

High-net worth and family offices have always been at the forefront of impact investing. With the freedom to deploy their capital as they see fit, they’ve been able to lead social and environmental movements with the power of their investments. They’re natural risk takers, with vision for future opportunities, and they can drive powerful positive outcomes when the right opportunities come along.

Foundations

Foundations may offer catalytic capital to support organisations with concessional financing that speeds their growth and their ability to deliver on their mission.

The key methods of impact measurement

Impact measurement is a very tangible output of an impact management process. Measuring impact outcomes needs to be precise, verifiable, and independent, and it has introduced exciting new ways for investors to analyse and value companies, beyond looking at traditional financial factors alone.

There are a range of frameworks available that investors use to assess the impact their investee companies are having on the world. Over the past decade these tools have been slowly harmonising, and today there is a set of best-practice frameworks that can be employed to build an impact measurement and management system.

The Impact Stack offers an easy-to-use blueprint for using these tools, and connecting them all together.

The following are some of the most widely used frameworks:

IRIS+ (GIIN)

The GIIN has developed the Impact Reporting and Investment Standards (IRIS+) which are designed to be a common reporting language for impact-related terms and metrics.

IRIS aims to enable performance comparisons and benchmarking, while also streamlining and simplifying reporting requirements for companies and their investors.

It’s the culmination of a group of 40 investors from around the world who are working to develop a standardised framework for assessing social and environmental impact.

Basically, IRIS is designed to play the role in impact investing that Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) bring to mainstream financial accounting.

Sustainable Development Goals (SDG) as Impact Framework

The SDGs are a set of 17 goals, established by the United Nations in 2015, they set the agenda for what they hope to achieve in the 15 years to 2030.

But, they’ve also become a unifying framework for companies and investors to view and measure the impacts they’re having on the world.

The power of the SDGs comes from their global scope, and its practical coverage of the 17 greatest challenges facing our world. Companies can identify which of the goals they are achieving by shifting their products, their operations, or even just their mindset. And, the SDGs are more sophisticated than simply a list of 17 goals.

Underneath the goals there are 169 targets which are actionable, and which allow for global comparison.

While 169 may sound like a lot, it’s actually a very broad set of targets when we consider the innumerable problems, and themes, that we need private enterprise to focus on. Fortunately, there are a number of organisations working to integrate the SDGs into a more nuanced framework to suit specific industries, and businesses:

SDG Compass

This tool helps companies align their strategies towards achieving the SDGs.

The online platform allows a company to enter the goals, and the sectors, that are relevant to them, and the system will suggest which indicators from other frameworks (such as the GRI) will help the company to measure, report and manage their impacts.

It was developed by GRI, the UN Global Compact and the World Business Council for Sustainable Development (WBCSD).

Impact Management Project (IMP)

The Impact Management Project (IMP) was a network of over 2,000 impact focussed organisations that came together to build a consensus on how impact can be measured, benchmarked and compared.

“The work of the IMP provides a lens to understand the impact performance of different enterprises and investments against the SDGs.”

This valuable work gave rise to a set of ‘impact norms’ that are now widely used by impact practitioners. The two key norms are:

Five Dimensions of Impact:

Investments can be measured on a whole range of factors, and this model defines five different angles from which you can view the impact outcomes of an investment:

- What

- Who

- How Much

- Contribution

- Risk

ABC Impact Classification Model:

The ABC model be used at the portfolio or investment level, to define the intended impact of a particular investment. It offers three categories of impact:

- Avoid harm

- Benefit stakeholders

- Contribute to solutions.

While the IMP organisation is largely wound-up, the important work of research and consensus building is now managed by Impact Frontiers.

Operating Principles for Impact Management – IFC

At the beginning of 2019 the International Finance Corporation (IFC) launched the Operating Principles for Impact Management. It’s a framework to help investors design their impact management systems with discipline and transparency.

They don’t prescribe specific impact measurement tools, but instead, the nine principles get everyone on the same page to bring a level of credibility and integrity; something that’s been sorely lacking. Each year the signatory’s (currently 90) progress reports will be made public, so we can see how some of the major players are managing this evolving issue.

Since 2023 this framework has been managed by the GIIN.

How to get started with Impact Investing

Impact investing has evolved, and there’s now a globally recognised suite of frameworks to use in developing an impact measurement and management system.

For investment managers wanting to design a rigorous impact investment strategy, The Impact Stack offers a best-practice model for designing an impact investment strategy.

The future of Impact Investing

Climate Tech and Renewable Energy

As the urgency of climate change intensifies, impact investors are expected to significantly increase their focus on climate technologies and renewable energy solutions. This includes investments in areas like energy storage, carbon capture and storage, sustainable transportation, and grid modernization.

Ai for Impact

The rapid advancement of AI is opening new frontiers for impact investing. Investors are likely to target AI applications that address social and environmental challenges, such as improving healthcare diagnostics, optimizing resource allocation in underserved communities, or enhancing environmental monitoring and conservation efforts.

Ai will undoubtedly enhance a businesses ability to manage carbon data and make their operations more efficient, but, large language models (LLM) use huge amounts of electricity, which is driving even more urgency for clean energy solutions.

Circular Economy and Sustainable Production

With growing awareness of resource scarcity and waste management issues, impact investors must support businesses that promote circular economy principles. This includes recycling technologies, sustainable materials, and innovative business models that minimize waste and maximize resource efficiency. And there will be further scrutiny on down-stream retail brands to use more sustainable packaging options, and take responsibility for waste.

Measurable Impact & Standardization

In 2025 we will see a major focus on standardisation of impact measurement and reporting. As the ISSB standards are adopted globally, this will filter down to allocators and LPs who will demand their investment managers align impact outcomes with a comparable standard. Ai will be useful here.