#62 Jacqueline Novogratz: Patient capital, impact businesses and finding your purpose

Jacqueline Novogratz founded Acumen Org, but now, she’s leading a moral revolution!

A podcast about the business of sustainability.

John Treadgold interviews business leaders in sustainability, ESG and impact investing who are re-defining economics and building companies as a force for good.

Jacqueline Novogratz founded Acumen Org, but now, she’s leading a moral revolution!

William Wu is portfolio manager at Melior Investment Management, and he teaches courses in sustainable investing at UNSW.

Michael O’Leary co-founded BainCapital’s DoubleImpact fund, he’s an advocate for the evolution of finance, and he’s published a book: Accountable, The rise of Citizen Capitalism.

Sir Ronald Cohen is chair of the Global Steering Group on Impact Investing, and he’s leading the adoption of impact-weighted accounts.

Rachel Etherington is a sustainable investing advisor, she understands impact, ESG and the SDGs, but most of all, she’s enthusiastic.

Michael Traill offers an update on the PM’s Social Impact Investment Taskforce, he’s the Chair, and a pioneer in the field.

Viktor Shvets explores history, economics and the psychology of debt in his new book, The Great Rupture

Ingrid Burkett & Alex Hannant are co-directors of the Yunus Centre, they’re designing the future of business.

John Elkington has been at the forefront of corporate sustainability since the 70’s. He’s an environmentalist, provocateur and author of the new book, Green Swans.

Simon O’Connor is CEO of RIAA, he’s back to discuss the 2020 Benchmarking Impact Report, it lays out the growth of impact investing, and the potential for it to grow to $100B in 5 years

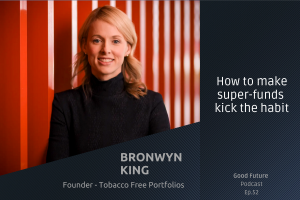

Bronwyn King is a cancer doctor, and when she found out her super was invested in tobacco she wasn’t happy, so she’s dedicated her life to driving tobacco-free portfolios.

Phil Vernon was CEO of Australian Ethical Investments for ten years. He’s been hugely influential in the responsible investment industry, and he’s not slowing down.